Housing markets continue to strengthen in March as prices rise

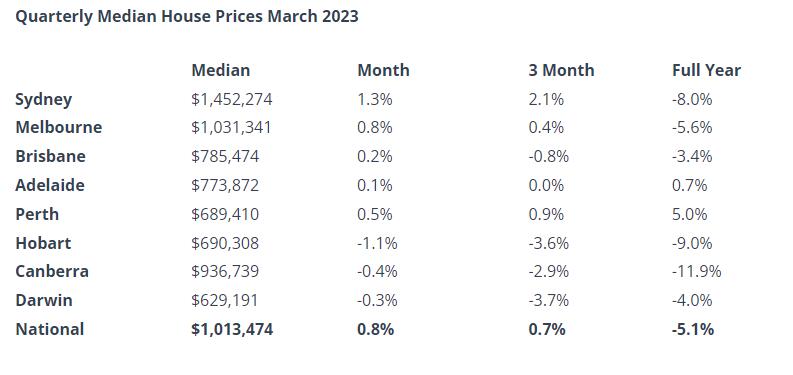

2023-03-31The national capital city quarterly median house price increased by 0.8% over March compared to the February result, with Sydney house prices up 1.3% and Melbourne house prices up 0.8%. Hobart, Canberra and Darwin bucked the trend with house prices falling by 1.1%, 0.4% and 3% respectively.

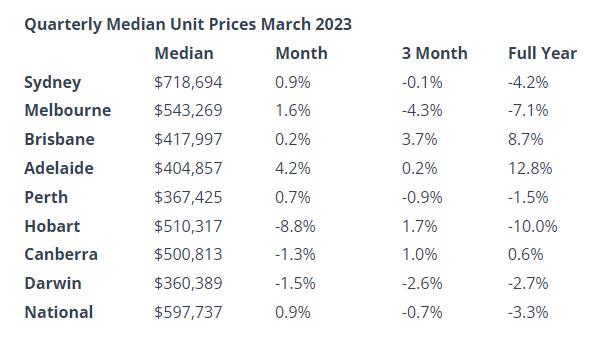

Unit prices have increased over consecutive months in most capitals with Adelaide the top performer up by 4.2% followed by Melbourne up by 1.6% and Sydney higher by 0.9%.

Capital city housing markets have started to recover, with prices increasing over consecutive quarters and most capitals now reporting higher monthly prices for both houses and units.

Housing markets will likely continue to revive through 2023 despite higher interest rates, with consumer activity remaining strong and rising. Value perceptions and rising FOMO energy will also encourage buyer activity, with the duration of the current official interest rate tightening cycle crucial.

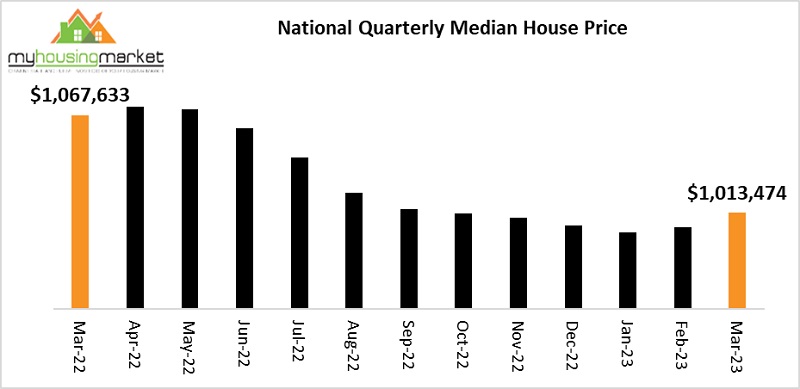

The national housing market has continued to strengthen over March following its revival over February, with quarterly house prices now rising for the second consecutive month.

The national capital city quarterly median house price increased by 0.8% over March compared to the February result - rising to $1,013,474, according to the latest data from My Housing Market.

The March increase was higher than the 0.3% rise recorded over February which followed 9 consecutive monthly falls in house prices.

Consecutive monthly house price rises reinforce the likelihood of a sustained growth cycle now emerging in the national capital city housing market.

Although national house prices increased again over March, prices remain 5.1% lower than reported the year before over March 2022.

Canberra remains the underperformer for annual house price growth falling by 11.9% over the year with Hobart down 9.0% and Sydney lower by 8.0%.

Perth remains the clear top performer with annual house prices higher by 5.0% with Adelaide marginally higher by 0.7%.

Houses

The March increase in the national house price reflected another sharp rise in the Sydney monthly house price that was higher by 1.3% and an increase of 0.8% in Melbourne – the first month for that capital rise since April 2022.

House prices also increased in Brisbane - up by 0.2%, with Adelaide up 0.1% and Perth higher by 0.5% and Canberra up 0.7%.

Hobart Canberra and Darwin bucked the trend with house prices falling by 1.1%, 0.4% and 0.3% respectively.

Five capitals reported monthly increases in house prices over March compared to just two with rises recorded over February.

Although house prices increased in most capitals over March, prices generally remain below the results recorded over March 2022 a year ago.

Canberra remains the underperformer for annual house price growth falling by 11.9% over the year with Hobart down 9.0% and Sydney lower by 8.0%.

Perth remains the clear top performer with annual house prices higher by 5.0% with Adelaide marginally higher by 0.7%.

Units

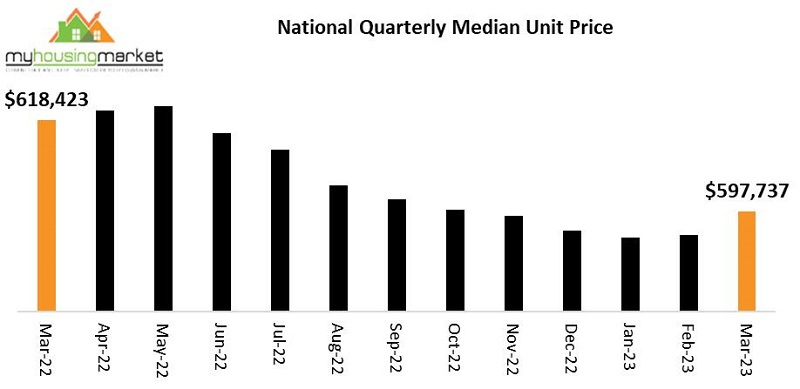

National capital city median unit prices have also reported consecutive months of price growth with the March result higher by 0.9% following the February increase of 0.1%.

The March national unit price at $597,737 is however lower by 3.3% compared to the March 2022 result a year ago.

Most capitals recorded higher unit prices over March with Adelaide the top performer up by 4.2% followed by Melbourne up by 1.6% and Sydney higher by 0.9%.

Monthly unit prices however were down by 8.8% in Hobart with prices also lower in Canberra and Darwin – falling by 1.3% and 1.5% respectively.

Similar to houses, Sydney unit prices have now increased over consecutive months with the rate of growth also higher than the February result.

Adelaide and Brisbane continue to report the highest annual unit price growth over March, up by 12.8% and 8.7% respectively.

Hobart and Melbourne however are the clear underperformers for annual unit prices growth down by 10.0% and 7.1% respectively.

Outlook

Capital city housing markets are showing clear signs of a consistent revival of prices for both houses and units following a lengthy period of declines over 2022 – particularly for Sydney and Melbourne.

The March national capital city median price for both houses and units has now increased over consecutive quarters. with the rate of growth accelerating.

And most capitals are now reporting higher monthly prices for both houses and units.

Booming economies with record-low jobless levels and the highest wages growth in a decade are continuing to support consumer activity with retail sales also remaining strong and rising.

Housing markets will continue to be supported by surging migration in already undersupplied housing environments as evidenced by chronically low rental vacancy rates driving already high rents even higher.

Value perceptions with prices still generally lower than those reported a year ago in most capitals will also encourage buyer activity providing momentum as FOMO energy rises.

The likelihood remains of a generalised revival in housing market activity through the autumn selling season as buyer and seller confidence rise.

The key to sustained growth however remains the duration of the current official interest rate tightening cycle with the RBA clearly uncertain as to the outlook, particularly for inflation.

Housing markets will likely continue to revive through 2023 despite the constraints of higher interest rates – although the trajectory of official rates will determine the rate of growth.

- *E-mail:

- *Cel:

- *Password: