The latest median property prices in Australia’s major cities

2023-02-06The median house price in Australia’s combined capital cities is $849,666.

The median unit price in Australia’s capital cities is $608,121.

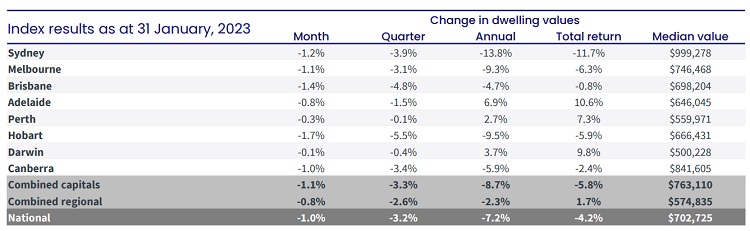

The median dwelling value in Australia’s combined regional areas is $574,835 .

But of course, there are markets within markets, so we detail the median prices for each capital city in this article.

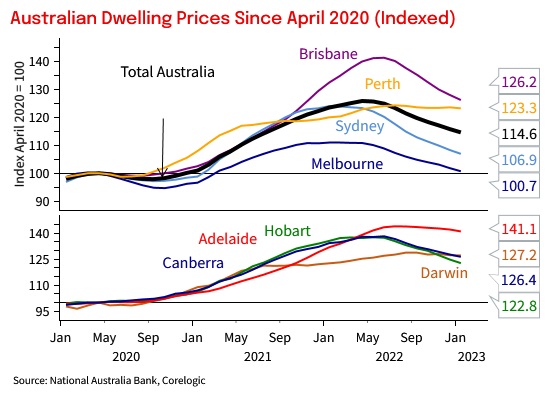

This time last year, Australia’s property market was closing out on a massive high as the "once in a generation" pandemic fuelled property boom was in full swing.

Buyers were still driven by a manic-sized dose of Fear of Missing Out (FOMO) and sellers, who achieved record prices, quickly became desperate buyers.

But as they say, “nothing lasts forever” and the property cycle has moved on.

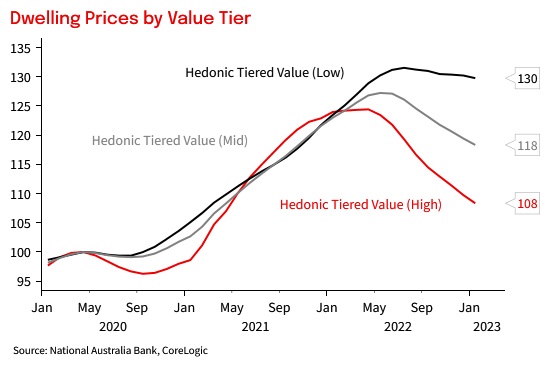

Now we're in the adjustment phase of the property cycle with housing prices falling around Australia.

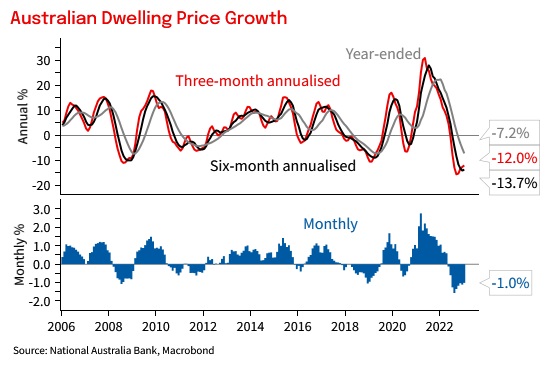

The latest CoreLogic’s national Home Value Index (HVI) shows a further decline rate of -1.0% in January, a slight improvement on the -1.1% decline recorded in December, and the smallest month-on-month decline since June last year.

• The median dwelling price for our combined capital cities now sits at $763,110

• The median dwelling price for our combined regional towns sits at $574,835

Current Australian house price trends

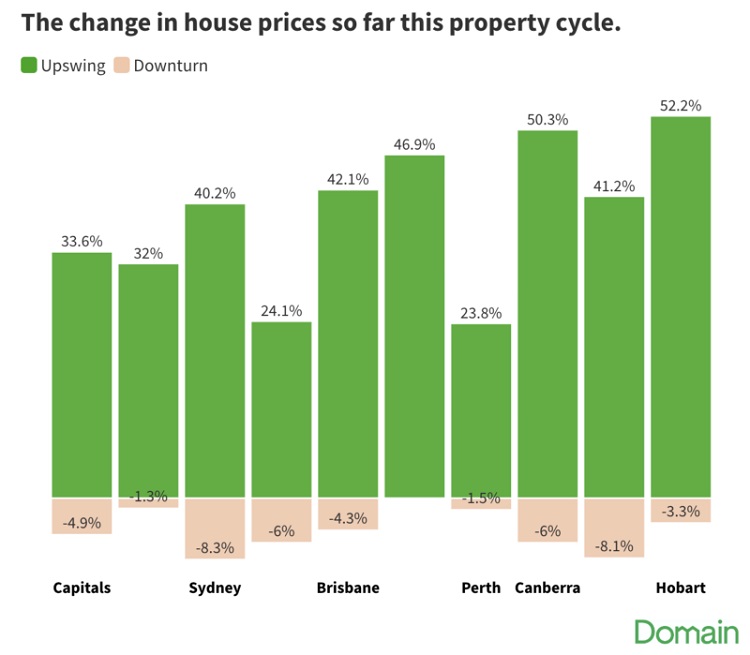

Domain’s chief of research and economics, Dr Nicola Powell, says 2022 has been a “roller coaster” of a year for property.

“The past two years have been fascinating to watch in real estate. After soaring price growth in 2021, it was inevitable that we would see an adjustment phase of the property cycle in 2022,” she says.

"This year, the market saw a stark contrast with house prices across the combined capital cities switching to their fastest quarterly decline on record.

As this took place, the property market rapidly shifted to provide buyers greater negotiation power. At the same time, affordability became an issue due to consecutive rate hikes and rising inflation creating weaker consumer confidence.

But here’s where some perspective is important.

While it may feel like the property market has done a complete 180, in reality, it’s way off that."

- *E-mail:

- *Cel:

- *Password: