Australia’s richest and poorest postcodes revealed, 2022/9/16

2022-09-16

Want to know where Australia’s richest people live?

New data from the Australian Taxation Office (ATO) has revealed where Australia’s highest-paid professionals live, with Perth taking the crown as home to the country’s most affluent people after a surge in income over the 2019-20 tax year.

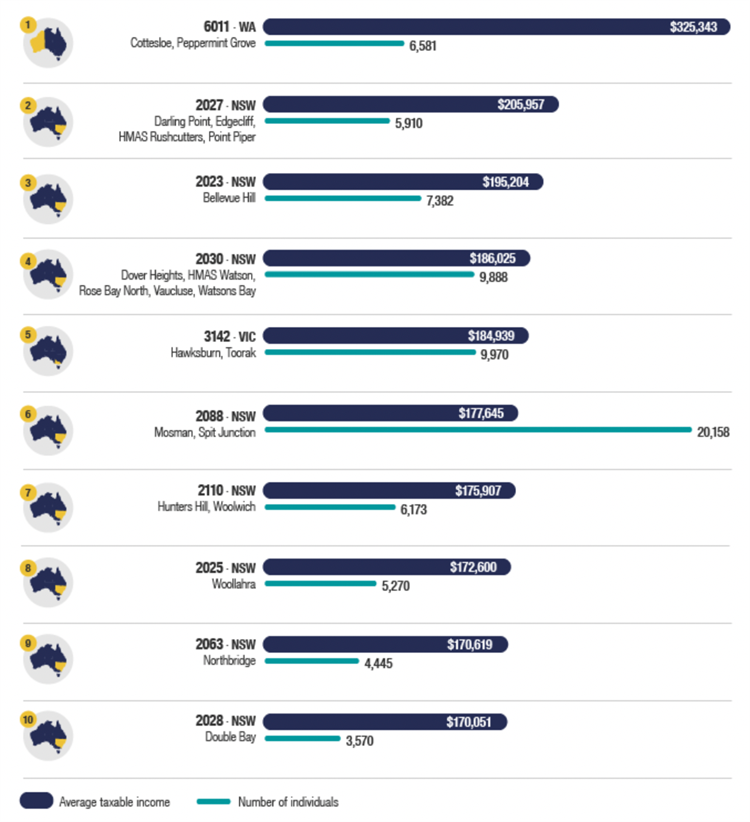

Cottesloe and Peppermint Grove in Western Australia’s 6011 postcodes stormed to the top of the list with a median $325,343 income for the year.

This is a huge increase (of over 80%) from the $179,376 median income recorded in the prior financial year which saw the famous seaside postcode positioned in 6th place on the top 10 list.

It’s the first time a postcode’s average taxable income has reached $300,000, which is even more outstanding given this happened amid the beginning of the Covid-19 pandemic.

In second place was the NSW 2027 postcode - home to Darling Point, Edgecliff, and Point Piper - with an average taxable income of $205,967.

This is a step up from sitting in third place last year.

Then finishing in third place is postcode 2030 - Bellevue Hill - with a $195,204 median, an increase from eighth place last year.

Postcode 2030 - Dover Heights, Rose Bay North, Vaucluse, and Watsons Bay - was fourth at $186,025.

In fact, with the exception of the top spot, the country’s top 10 richest postcodes were dominated by some of the most exclusive spots across Sydney.

Other Sydney suburbs that made up the remaining five postcodes included Mosman, Split Junction, Hunters Hill, Northbridge, Woollahra, and Double Bay.

Melbourne only placed once on the list - postcode 3142 which is Hawksburn and Toorak - in fifth place with an average $184,939 income.

Top 10 richest postcodes by average individual taxable income

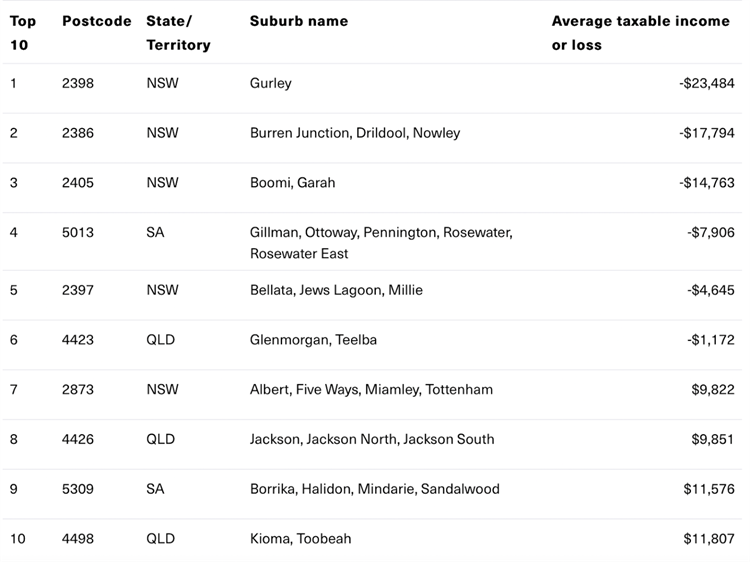

The 10 poorest postcodes in Australia

NSW featured heavily on the top 10 richest postcode list, but the same level of wealth was not shared in regional parts of the state, with NSW areas also accounting for five of the top 10 poorest postcodes.

According to the ATO’s taxation data, postcode 2398 - Gurley - postcode 2386 - Burren Junction, Drildool and Nowley - and postcode 2405 - Boomi and Garah - made up the top three respectively.

2398 and 2386 sat at the top of the poorest postcode list last year but 2405 is a newcomer for the 2019-2020 tax year.

These three postcodes all had a negative average taxable income for the year, which given their location in rural NSW was likely associated with farming losses.

Postcode 2397 - Bellata, Jews Lagoon, and Millie - and postcode 2873 - Albert, Five Ways, Miamley and Tottenham - were the other NSW locations featured on the list.

The rest of the top 10 was made up of mainly rural postcodes in South Australia and Queensland, except for postcode 5013 in Adelaide’s north - Gillman, Ottoway, Pennington, Rosewater, and Rosewater East - which came in fourth place with a negative average taxable income of -$7906.

Top 10 postcodes with the lowest average taxable income

It's worth pointing out that the postcodes with lower average taxable incomes have significantly smaller populations and a smaller number of individuals that lodged tax returns in many instances.

For example, the top three postcodes listed have a combined individual total of 618 whereas the richest 6011 postcodes - Cottesloe and Peppermint Grove - has 6,581 individuals.

Millionaires who paid no tax

Not only has the latest ATO data listed the richest and poorest suburbs in Australia, but it also revealed that a whopping 60 millionaires paid no tax in the 2019-20 financial year.

There were 60 Australians who earned more than $1 million in that financial year who did not pay a cent of income tax, compared to 66 the year before.

On average these 60 individuals earned $3.5 million each.

All up these 60 millionaires claimed a total of $165.3 million worth of different deductions to reduce their tax bills.

The Australian Taxation Office's (ATO) latest taxation statistics are based on the tax returns of almost 15 million Australians for 2019-20.

Location, location, location

When it comes to property investing, it’s worth remembering that location does 80% of the heavy lifting of a property’s capital gain.

While this recent data reveals areas where the property is expected to hold its value best, this isn’t necessarily where I’d recommend investing.

What’s important is to look for an investment grade property in the ‘right area’ rather than chasing ‘top hotspot’ or growth areas.

But even before looking for the right location, make sure you have a Strategic Property Plan to steer you through the upcoming challenging times our property markets will encounter.

You see…property investing is a process, not an event.

Things have to be done in the right order – and selecting the location and the right property in that location comes right at the end of the process.

Fact is, the property you will eventually buy will be the result of a sequence of questions you will need to ask and answer and a series of decisions you’ll need to make before you even start looking at locations.

Long before we talk about a property or the right location with our clients at Metropole, we look at factors including their age, their timeframes, and the desired end results in other words, what do they really want the properties to do – are they looking for cash flow, capital growth, or a combination of both.

And that’s because what makes a great investment property for me, is not likely to be the same as what would suit your investment needs.

So at Metropole, it all starts with helping our clients formulate a Strategic Property Plan which takes into account their surplus cash flow position, their risk profile (for example would they consider undertaking renovations or small development), and whether they currently own a home or are wanting to buy a new home or upgrade their existing home in the future, if they are going to earn more income in the future, or if they’re going to decrease their family income because they’re having a baby, how many other investment properties they own, where they are located and how they are performing plus 35 other considerations.

Source: Steffi Sendecki, propertyupdate.com.au 15/9/2022

- *E-mail:

- *Cel:

- *Password: