Sydney and Melbourne house prices now falling – others fading | June 2022 Market Update, 2022/6/30

2022-06-30

Sydney and Melbourne house prices are now falling as sharply higher interest rates reduce already low affordability and impact market confidence.

Although other capitals are still recording robust price increases, growth levels have declined significantly from the peaks of recent quarters.

Sydney and Melbourne down following 2 years of growth

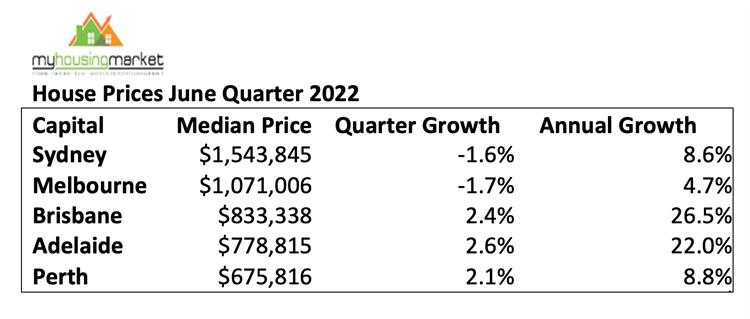

Sydney recorded a median house price of $1,543,845 over the June quarter according to the latest data from My Housing Market, which is a decline of 1.6% compared to the March quarter result.

The fall in Sydney house prices was the first local decline reported since covid lockdowns closed the market over the June quarter of 2020.

Despite the latest June quarter fall, Sydney house prices remain 8.6% higher than recorded over June 2021.

Melbourne also reported a fall in house prices over the June quarter - lower by 1.7% to $1,071,006 and followed a flat result over the March quarter.

Similar to Sydney, Melbourne recorded its first decline in house prices since lockdowns closed housing markets in 2020.

Melbourne house prices remain 4.7% higher compared to June 2021.

Brisbane and Adelaide house prices still rising but growth rates continue to ease

Adelaide is now the leading capital for house price growth – rising by 2.6% over the June quarter to $778,815.

The rate of increase however has again fallen over the quarter and is well below the recent peak recorded over the December quarter last year of 6.9%.

Adelaide house prices have nonetheless increased by 22.0% over the past year.

Brisbane house prices recorded another strong increase over the June quarter, rising by 2.4% to $833,338.

Similar to Adelaide however, the quarterly rate of increase has diminished significantly since the remarkable recent peak of 11.5% recorded over the December quarter of 2021.

The Brisbane housing market was the top capital city performer for house price growth over the 2021-22 financial year – rising by an extraordinary 26.5%.

Perth house prices increased by 2.1% over the June quarter to $675,816 – a similar result to the March quarter, with annual prices now higher by 8.8%.

Property market outlook

Recent boomtime housing market conditions have clearly eased, with most capital cities recording significant declines in growth levels over the June quarter compared to recent results.

Sharply higher prices over 2021 and into 2022 have reduced affordability, sidelining buying activity.

Pent-up demand generated from covid interruptions to the market over recent years has also been largely satisfied.

The early high-flying markets of Sydney and Melbourne have reported flattening and now falling house prices over 2022 so far, reflecting sharply increasing affordability barriers with house price declines likely to continue over the remainder of the year.

The more affordable capitals of Adelaide and Brisbane however continue to record strong house price growth albeit at significantly reduced levels compared to recent quarterly results as sharply higher prices also act to reduce buyer capacity and activity.

Recent extraordinary increases in official interest rates – the first in over a decade, will also impact affordability with market confidence under increasing pressure from a rising tide of negative sentiment.

Lower house price growth levels are set to continue - exacerbated by the usually quieter winter selling season and the impact on household budgets of sharply rising inflation - and more interest rate rises are clearly to come.

Underlying demand and supply imbalances however will support housing market activity - enhanced by the resumption of mass migration, a surge in international students, significant new stimulus policies for first home buyers and investors chasing higher returns from tight rental markets – with continuing lower levels of new residential buildings amplifying existing housing shortages.

- *E-mail:

- *Cel:

- *Password: