With Conservative majority removing Brexit uncertainty, Hongkongers are poised to return to London p

2019-12-23Published SCMP: 10:45am, 18 Dec, 2019

• Strong mandate for Prime Minister Boris Johnson will finally clear the Brexit fog surrounding London’s real estate market, analysts say

• In swift response, Hong Kong-based K&K Property has announced a £130 million purchase of Orion House in Covent Garden

The overwhelming victory of the Conservative party in the UK elections is likely to lift the prices of London property and convince Hongkongers to snap up real estate in the British capital.

Some analysts said the clear mandate given to Boris Johnson, who retains his post as British Prime Minister, will finally lift the fog of uncertainty clouding London’s real estate market.

“For the property market, this is good news,” said Damien Siviter, group managing director at UK developer SevenCapital. “The uncertainty over the past few years as we remained in this limbo of ‘are we, aren’t we going to leave?’ has had a knock-on effect, hindering some projects which in a normal situation would have gone ahead with little issue and causing hesitation from investors.”

“The office building will provide attractive rental income,” said chief executive Kino Law Kin-yat. “We will actively explore opportunities for different types of commercial projects and will expand our land bank at different options.”

Law, a former UBS investment banker, is the grandson of the late founder Law Ting-pong who built his fortune on the Bossini fashion retailing business before venturing into the property market at home and in Singapore. The Orion House represents its first foray into the UK market, he added.

With the Conservative Party claiming 365 seats in the House of Commons, it is a large enough majority to push through legislation for the UK to leave the European Union. Johnson has vowed to deliver Brexit by January 31.

Between the Brexit referendum in June 2016 and the latest electoral outing, the uncertainty over Brexit had dragged down investment volumes as well as prices of properties in central London as investors held back on their purchases.

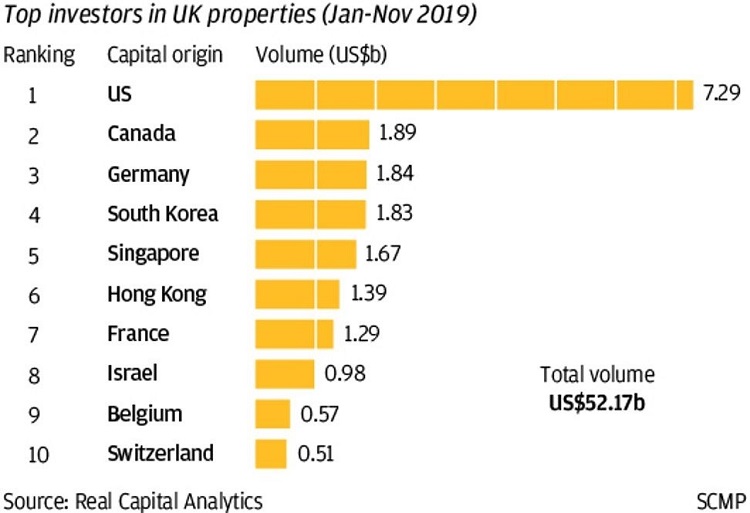

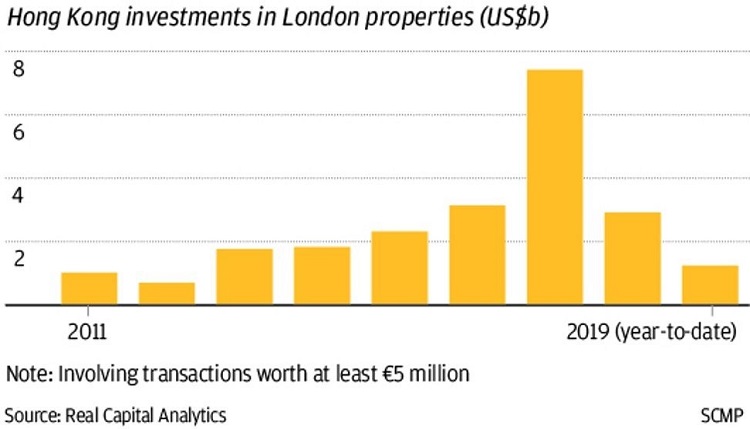

Commercial investment in the UK from Hong Kong investors amounted to just US$1.5 billion so far this year, half the US$3.1 billion spent last year, according to property consultancy Knight Frank.

Hong Kong investors were the biggest buyers of UK properties in 2015 to 2018. So far this year, they have slipped to fifth for two reasons, Knight Frank said.

“Now, with the lifting of the political fog, London looks like an exceptional buy, particularly when compared with the likes of Paris, Milan and Berlin,” said Paul Hart, executive director, Greater China, and head of commercial at Knight Frank. “London’s appeal, in terms of investment return, will definitely draw out Hong Kong investors in 2020.”

Notwithstanding the mandate for Johnson, others believe there is still some economic uncertainty to contend with, including a trade package with the European Union. Sellers could jack up their asking prices as well, according to Savills, suggesting a bounce in demand in the first part of 2020 could prove difficult to sustain in subsequent months.

“The election result should unlock some deals and mean prospective buyers are more committed, bringing a greater sense of urgency to the market,” said Lucian Cook, head of UK residential research at Savills. “However, there is a possibility that it will also harden some sellers’ price expectations.”

- *E-mail:

- *Cel:

- *Password: