U.S. Capital Flows Down from Record 2018 Levels

2019-08-12

With the longest global economic expansion on record, international investors face an increasingly complex calculus in identifying cost-effective opportunities for potential downturn protection, slowing the pace of cross-border capital flows to and from the U.S.

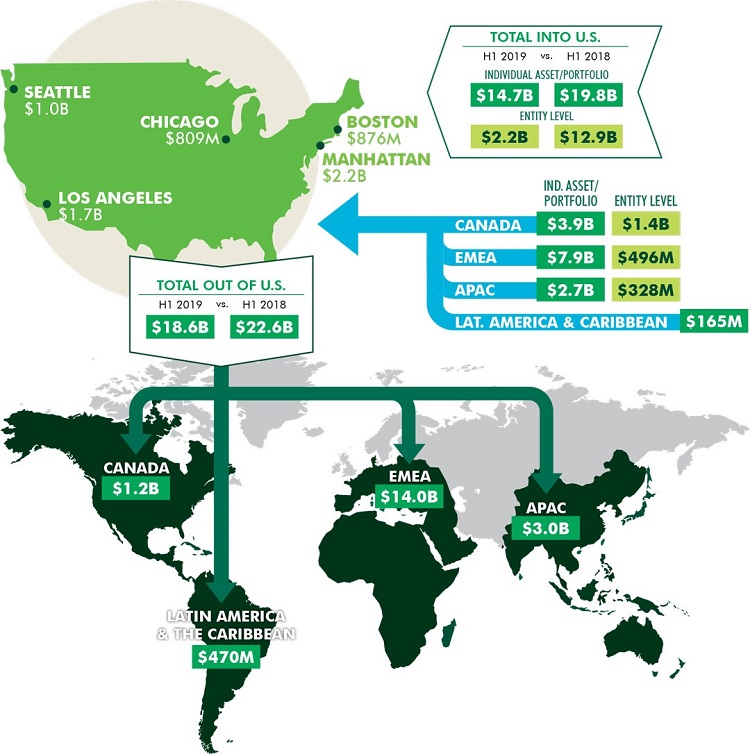

Inbound capital to the U.S. in the first half of 2019 totaled $17 billion, a decrease of 48% from H1 2018. About half of this decline was due to less M&A activity after record levels in 2018. Cross-border investment volume of individual assets and portfolios (excluding entity-level) was down by 26% relative to H1 2018.

U.S. outflows to foreign regions also decreased in H1 2019, falling 18% year-over-year to $18.6 billion. Given the less-pronounced pullback in outbound capital, overseas outflows by U.S. investors outpaced U.S. inflows from foreign investors, reversing the trend of the past four years.

Note: All figures in U.S. dollars. Transactions include office, retail, industrial, hotel, multifamily and seniors housing. Development sites are excluded.

Source: CBRE Research, Real Capital Analytics, August 2019.

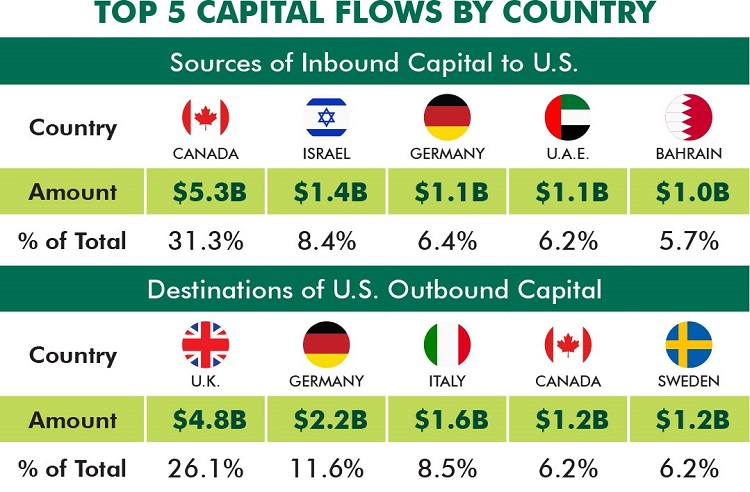

Inbound volume from APAC dropped most notably—particularly from China and Singapore, which had been among the top-five capital sources in recent years—and the region’s share of total capital inflows to the U.S. shrank to 18% from 32% in H1 2018. Meanwhile, regional share for the Middle East increased nearly fivefold to 24% from less than 5%.

In contrast to the large regional share shifts in inbound capital, U.S. capital was deployed to foreign regions at roughly the same proportions as in H1 2018. Despite heightened uncertainty about Brexit, U.S.-originated investment increased significantly in the U.K., which has been the top foreign destination of U.S. capital for the past 10 years. In Sweden and Italy, triple-digit growth rates moved both countries into the top five for U.S. capital in H1 2019. Nevertheless, this was not enough to fully offset pullbacks to other major European destination countries, and outflows to the region were down by 16% from H1 2018.

- *E-mail:

- *Cel:

- *Password: